Retirement Protection Plus (RPP) is not a pension plan, qualified retirement plan, or a qualified individual retirement account, nor a substitute for one. Rather, it is a program that provides disability income insurance to replace retirement plan contributions made by you and your employer in the event you become totally disabled. The Retirement Protection Plus Program is available for this specific purpose and is issued with the Provider Choice IDI policy having the same base policy language and Non-Cancellable & Guaranteed Renewable provision.

| Need For Retirement Protection Plus (RPP) Coverage |

| How Retirement Protection Plus (RPP) Works |

| Retirement Protection Plus (RPP) COLA Rider |

| Retirement Protection Plus (RPP) FIO Rider |

Need For Retirement Protection Plus (RPP):

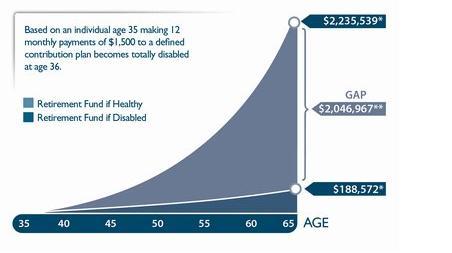

If you became totally disabled, even if you had adequate group plus individual disability protection that would pay benefits to 65 or 67 would you be able to still put money away to save for retirement? Chances are you would likely need all of your disability benefits to live on since your disability benefits are likely going to be less that your pre disability after tax earnings. Additionally, if you are no longer working for a company because of disability, your former employer would not be able to put money into your retirement plan, even if they wanted to, because you are no longer an employee.

A long term disability can reduce the contributions into the retirement account resulting in less funds you have in retirement. This may resulting in you having a reduced retirement lifestyle from what you may have planned.

How Retirement Protection Plus (RPP) Works:

You are eligible for benefits when you are totally disabled and not working (modified own occupation). An option of Two Year True Own Occ is available on a stand alone policy. Once eligible for benefits, a monthly benefit up too 100% of your retirement contributions selected at time of purchase, including any employer-matching contributions, will be paid into an irrevocable trust. The trustee invests the benefits at your direction. The benefit period must be to age 65 and benefit periods available are 180 or 360 days.

Retirement Protection Plus (RPP) COLA Rider:

The COLA riders available under the RPP program are the same as it is on Provider Choice as long as the RPP coverage is issued as a separate policy vs being added to another Provider Choice policy as a rider. The cost of living riders adjust your policy's monthly benefit annually to help keep pace with inflation during a disability. They include annual adjustments and a minimum benefit adjustment of 3%, calculated on a compounded basis. Additionally, should you recover, you'd automatically retain increases, free of charge, until age 65. With many carriers, the increases are Consumer Price Index tied (CPI) and you must pay for any increases in coverage to keep upon returning to work.

Retirement Protection Plus (RPP) FIO Rider:

The FIO rider is the same rider available on other Provider Choice policies. This rider helps protect the ability to purchase more disability protection as your retirement contributions increase without having to show evidence of insurability. Here how it works:

Retirement Protection Plus is not a pension plan, qualified retirement plan, qualified individual retirement account, or a substitute for one.

Financial Representatives of the Guardian Life Insurance Company of America (Guardian), New York, New York. Financial Growth Partners is a wholly owned subsidiary of Guardian. Guardian, its subsidiaries, agents, and employees do not provide tax, legal, or accounting advice. Consult your tax, legal, or accounting professional regarding your individual situation. This website contains the opinions of the author but not necessarily those of The Guardian Life Insurance Company (Guardian), New York, NY or its subsidiaries and such opinions are subject to change without notice. Important Disclosures: www.guardianlife.com/disclosures Terms and Conditions Privacy Policy

This website is intended for general public use. By providing this content, The Guardian Life Insurance Company of America, and their affiliates and subsidiaries are not undertaking to provide advice or recommendations for any specific individual or situation, or to otherwise act in a fiduciary capacity. Please contact a financial representative for guidance and information that is specific to your individual situation.

Individual disability income products underwritten and issued by Berkshire Life Insurance Company of America (BLICOA), Pittsfield, MA or provided by Guardian. BLICOA is a wholly owned stock subsidiary of and administrator for the Guardian Life Insurance Company of America (Guardian), New York, NY. Product provisions and availability may vary by state.

2024-171414 Exp 4/26